Forex trading, often referred to as FX, is the world’s largest financial market where currencies are bought and sold. Whether you’re a beginner or an expert in forex trading, understanding the role of forex brokers, how FX is traded, and the significance of global FX markets is crucial for success. In this blog, we’ll address essential questions to help you navigate the world of forex brokerage and trading.

What is Forex Brokerage?

A forex brokerage is a company or firm that provides traders with access to platforms that facilitate the buying and selling of foreign currencies. In other words, forex brokers act as intermediaries between individual traders and the larger currency markets. They provide the necessary technology, support, and access to liquidity providers to ensure smooth and efficient trading.

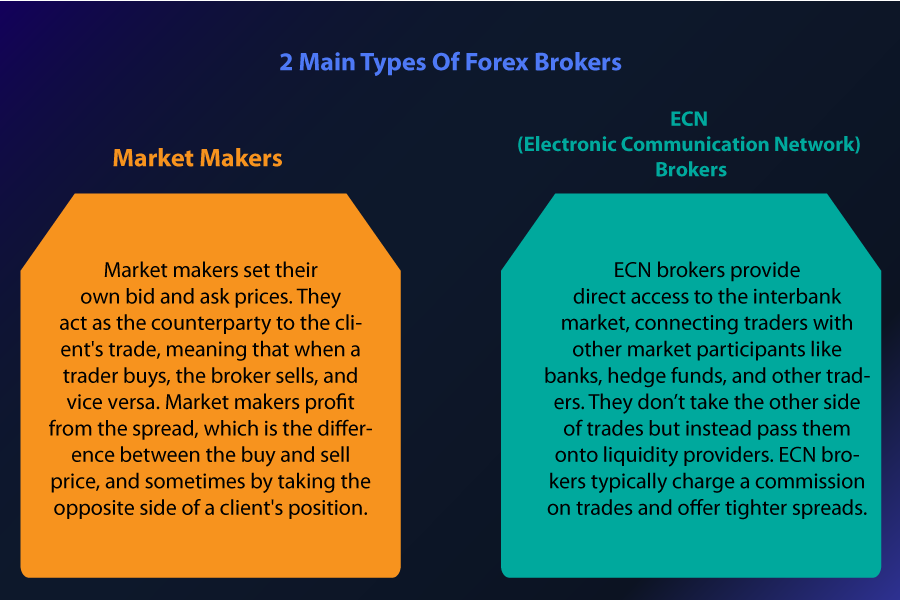

Forex brokers come in two primary types: market makers and ECN (Electronic Communication Network) brokers.

- Market Makers: These brokers essentially ‘make the market’ by setting their own bid and ask prices. They take the other side of a client’s trade, meaning they profit when a client loses and vice versa. This model can lead to conflicts of interest if the broker manipulates prices.

- ECN Brokers: ECN brokers provide direct access to the forex market by connecting traders with liquidity providers. They typically charge a commission and offer lower spreads. These brokers do not trade against their clients, eliminating any conflict of interest.

When choosing a forex broker, consider important factors such as regulation, spreads, leverage, and customer support.

Which is the Best Broker for Forex?

Determining the best broker for forex trading depends on several individual factors, including trading style, experience level, and specific needs. Here are some of the most respected forex brokers globally:

- IG Group: Known for its broad market access, user-friendly platform, and robust regulation, IG is a preferred choice for both novice and experienced traders.

- OANDA: OANDA offers low spreads, great educational resources, and tools that are especially beneficial to beginner traders.

- CMC Markets: With competitive pricing and an award-winning platform, CMC Markets is a top choice for traders looking for deep liquidity and tight spreads.

- Interactive Brokers: This broker is ideal for professionals, offering advanced trading tools, global market access, and low commission fees.

- Saxo Bank: Saxo Bank is popular among high-net-worth traders, offering advanced tools, premium customer service, and a range of products beyond forex.

To find the best broker for your needs, you should consider factors like:

- Regulation: Make sure the broker is licensed by a recognized regulatory body like ASIC (Australia), FCA (UK), or CySEC (Cyprus).

- Spreads and Fees: Lower spreads and transparent fee structures are always beneficial.

- Leverage: While leverage can amplify profits, it also increases risk. Different brokers offer different leverage levels, so select one that suits your risk appetite.

- Trading Platform: User-friendly platforms like MetaTrader 4 or 5 are widely regarded, but ensure the broker provides tools and features that match your trading strategy.

How is FX Traded?

Forex (FX) trading is the act of buying one currency and simultaneously selling another. Forex trading occurs in currency pairs like EUR/USD, where traders speculate on the price movements between two currencies. Here’s a breakdown of how FX is traded:

Currency Pairs

Forex trading involves pairs of currencies. The first currency in the pair is known as the base currency, and the second is the quote currency. For example, in the EUR/USD pair, EUR is the base currency, and USD is the quote currency.

Market Orders

To trade, traders can use different types of orders:

- Market Order: A buy or sell order executed immediately at the current market price.

- Limit Order: An order placed to buy or sell a currency pair at a specified price or better.

- Stop Order: A stop order becomes a market order once a specified price is reached.

Trading Sessions

The forex market operates 24 hours a day, five days a week. The major trading sessions include the London, New York, Tokyo, and Sydney sessions. Trading activity is highest when these sessions overlap.

How Do Banks Trade FX?

Banks are major players in the forex market, trading for various reasons, such as facilitating international transactions, managing risk, or for speculative purposes. Banks use proprietary trading desks to engage in FX trading and often deal in large volumes. Here are the main ways in which banks trade forex:

Interbank Market

Large banks trade forex through the interbank market, where they deal directly with each other. The interbank market offers deep liquidity and tight spreads due to the sheer volume of transactions.

Currency Hedging

Banks engage in hedging to protect themselves and their clients from fluctuations in currency values. This involves using forward contracts or options to lock in exchange rates for future transactions, minimizing the risk of adverse price movements.

Speculative Trading

Banks also engage in speculative forex trading to profit from currency price movements. They do this by taking positions based on macroeconomic trends, geopolitical events, and interest rate differentials.

Banks use sophisticated algorithms and trade through multiple platforms to ensure they get the best execution prices in the market.

What is Global FX Trading?

Global FX trading refers to the international trading of currencies across different time zones and regions. The forex market is truly global, connecting traders, institutions, and businesses from all corners of the world.

Market Size and Liquidity

The global forex market is the largest financial market, with a daily trading volume exceeding $6 trillion. This high volume provides liquidity, meaning trades can be executed quickly, and there is always a buyer or seller available.

Participants in Global FX Trading

The participants in the global FX market include:

- Central Banks: Central banks like the Federal Reserve, ECB, or Bank of Japan intervene in the forex market to manage their country’s currency value and stabilize the economy.

- Commercial Banks: As mentioned earlier, banks play a major role in forex trading by providing liquidity and executing large-scale transactions.

- Corporations: Global businesses engage in forex trading to exchange currencies for international trade and investment purposes.

- Retail Traders: Individual traders (often through brokers) participate in the forex market to speculate on price movements.

Advantages of Global FX Trading

Some of the key advantages of global FX trading include:

- High Liquidity: Due to the large number of market participants, forex markets are highly liquid, meaning transactions can be made quickly and efficiently.

- 24-Hour Trading: The forex market is open 24 hours a day, allowing traders to respond to news and events in real-time.

- Leverage: Forex trading often allows traders to use leverage, increasing potential profits (and risks) with a smaller initial investment.

Forex Trading in Australia

Foreign Exchange Market Trading is regulated in Australia and you can find ASIC regulated forex brokers here. Remember, in our globally connected world, the forex market is a dynamic and complex global marketplace with many factors at play. Whether you’re trading through a broker, learning how banks handle FX, or participating in global trading sessions, understanding the inner workings of forex trading can lead to more informed decisions and greater success in your investing journey.

Our dedicated team believes that FX trading should not only be profitable but also enjoyable. That is why we’ve created a fun community you can be a part of. Contact us to join us.

No comment yet, add your voice below!